Riyad Taqnia Fund - Riyad Capital

Riyad Taqnia Fund

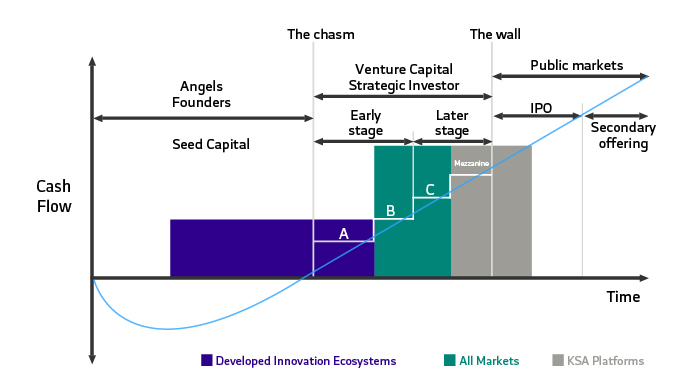

Riyad TAQNIA Fund (RTF), a close-ended Venture Capital fund founded by Riyad Capital and TAQNIA company , invests in audacious capital and aims to achieve high returns to investors. It is backed by leading institutional investors in Saudi Arabia and invests in the areas of Information & Communications Technology (ICT), Energy & Sustainability and Advanced Materials.

Learn More...

Fund Manager

Riyad Capital is managing the fund's investments, through a selection of investment experts, in line with the fund’s strategy towards achieving its goals. Riyad Capital is a Saudi Closed Joint Stock Company, licensed by the Saudi Capital Market Authority (NO.07070-37) to provide securities services such as, dealing as principal, and agent, underwriting, arranging, advising, and custody.

Believing in the importance of managing wealth and planning for future financial needs, Riyad Capital provides a wide range of investment products and solutions through a team of experts in investment and financial planning, assets management and corporate investment banking.

Riyad Capital enjoys the benefits of being a subsidiary of Riyad Bank, one of the largest financial institutions in Saudi Arabia. This relationship with Riyad Bank allows Riyad Capital to draw on the Bank’s expertise and accumulated experience.

Disclaimer

The information shows a Private Investment Fund information in which its units have been offered as a private placement in accordance to the Investment Funds Regulations issued by the Capital Market Authority (CMA). Riyad Capital's publication of this information shall not be considered as a verification of the feasibility of investment in such fund in any way, Riyad Capital expressly disclaims any liability incurred or could be incurred from investing in the fund units, or from using or relying on the information herein.

The investment fund mentioned is addressed to specific persons in accordance to the Investment Funds Regulations and are not for public offering, investing in such fund involves high risk, the potential unitholders who are willing to invest shall consult their legal and financial advisors on the feasibility or appropriateness of investing in such fund and shall revise the relevant documents to be able to estimate feasibility and appropriateness of investment.

Technical Advisor

Investment Objectives

Investment Committee

Key Fund Terms

RTF Portfolio companies

Contact us

Riyad Capital

2414 - Al Shohda Dist. , Unit No. 69

Riyadh 13241 – 7279

Email: rtfund@riyadcapital.com